Breen Law Firm understands that your peace of mind and the security of your assets are of utmost importance. In today's complex financial landscape, planning for the future is not just a wise choice; it's a crucial one. One powerful tool that we advocate for at our firm is the establishment of trusts. Trusts serve as pillars of stability, offering a secure way to protect and manage your wealth for both you and your loved ones. Let our legal experts guide you through the intricacies of trust establishment and management, tailoring solutions to your unique needs.

Estate Planning

The Basics

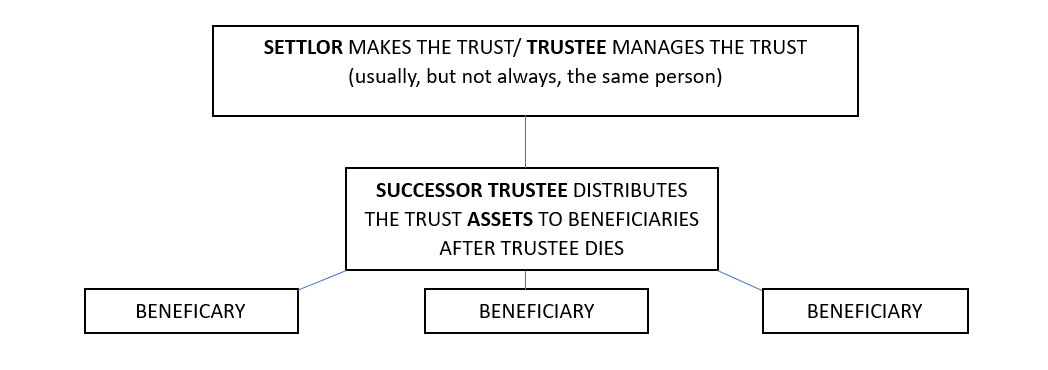

1. SETTLOR: YOU are the Settlor – YOU made the trust; YOU are the only one who can amend (make changes) to the trust during your lifetime.

2. TRUSTEE:

YOU are the Trustee – YOU legally own all of the assets in the trust, and you are in charge of managing the assets and using them for YOUR benefit for YOUR lifetime.

a. SUCCESSOR TRUSTEE: When YOU die or are no longer able to manage YOUR trust, YOU appoint a person or persons to follow YOUR trust and distribute YOUR assets according to YOUR wishes as stated in the trust.

3.

BENEFICIARY:

Who will receive your assets when you die?

a.

NOTE: A Successor Trustee can also be a Beneficiary.

4. ASSETS: YOUR property that is held in the trust.

a. During YOUR lifetime, the ASSETS are YOURS, and should be used for YOUR support, maintenance, health and welfare.

b. When YOU die, YOU designate the person or persons or institution that will receive YOUR ASSETS.

POUROVER WILL: A simple will that states YOU are leaving everything to your TRUST. Acts as a safety net to insure that none of your assets get dragged into Probate.

POWER OF ATTORNEY: Someone who YOU designate to handle your financial and business affairs for you, WHILE YOU ARE ALIVE, if you cannot handle them yourself.

HEALTH CARE AGENT: Someone who YOU designate to make healthcare decisions for you , WHILE YOU ARE ALIVE, if you cannot make those decisions yourself.

Common Estate Planning Myths

''Trusts are only for the very wealthy.''

In California, any real property worth $65,500 or more is subject to probate unless

·It is held in a joint tenancy;

·It is held in a trust;

·It is subject to a transfer on death deed.

This year, any estate with more than $166,250 in cash assets is also subject to probate.

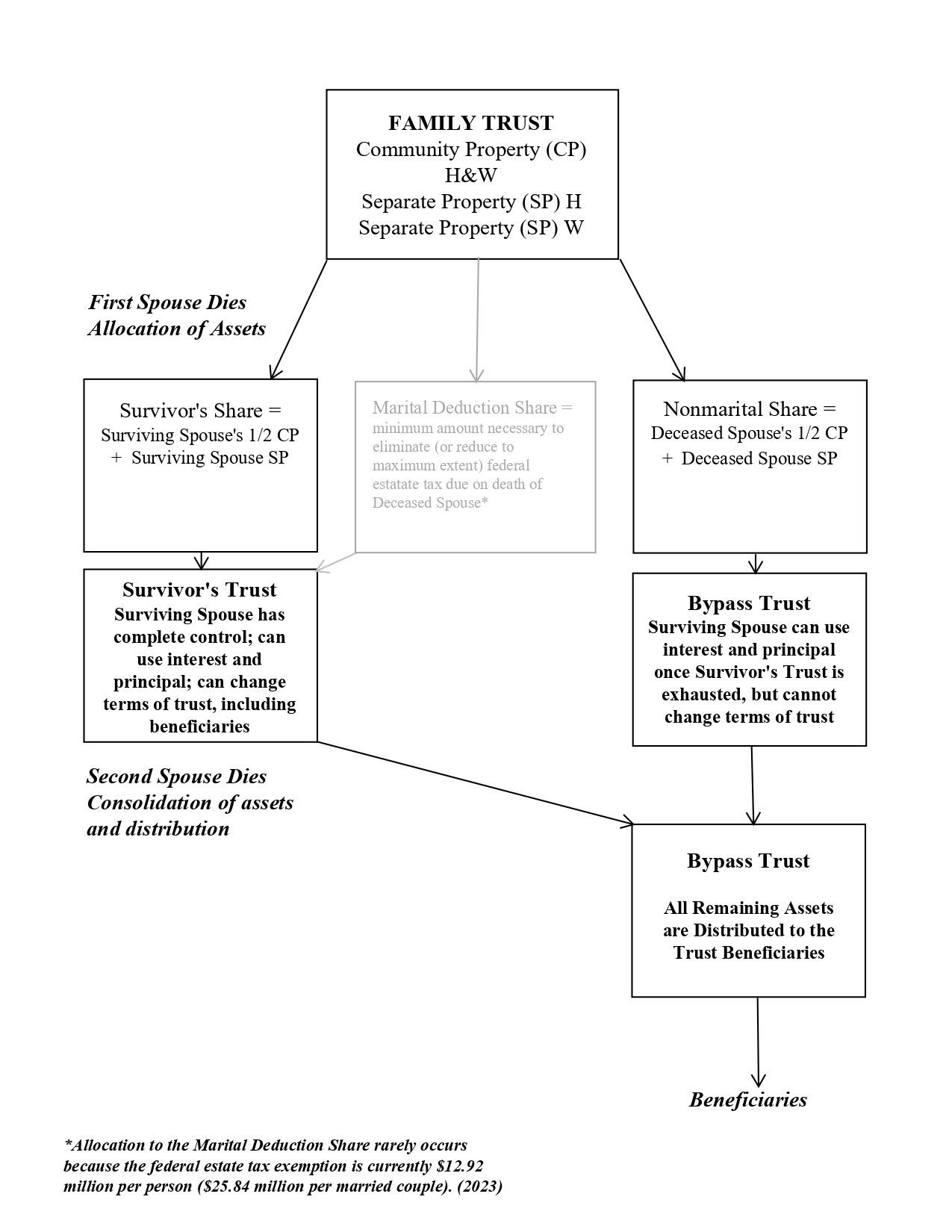

''A trust will protect my property from taxes.''

Although a trust does not protect assets from being taxed, California does not have an estate tax.

The federal estate tax exemption this year is $12.92 million per person ($25.84 million per couple).

On January 1, 2026, federal estate tax will reset to $5 million per person ($6.2 adjusted for inflation) unless Congress extends.

''Creating a living trust is complicated and/or expensive.''

Costs of setting up a revocable trust and estate plan range from $2,000 to $10,000.

The alternative: if you die without a trust, and your estate is worth $1,000,000, legal fees in probate court will be AT LEAST $26,000.

When is a Trust Advisable?

•YOU OWN REAL PROPERTY IN CALIFORNIA WORTH MORE THAN $61,500.

•YOU OWN PERSONAL PROPERTY WORTH MORE THAN $184,500.